From timesheet to paid—in three clicks.

Add earnings, or bulk-upload your timesheet

Add hours and earnings manually or upload a spreadsheet—Blink maps it automatically

BlinkPayroll crunches wages & taxes

100% accuracy guarantee. Federal, all 50 states, all localities. We've got you.

Pay & file taxes —automatically

Employees get ACH in 3 days (or next‑day*) and every tax form hits the IRS & states on time.

Manage all your companies from one place

Invite people to collaborate or just view reports

Need a bonus run?

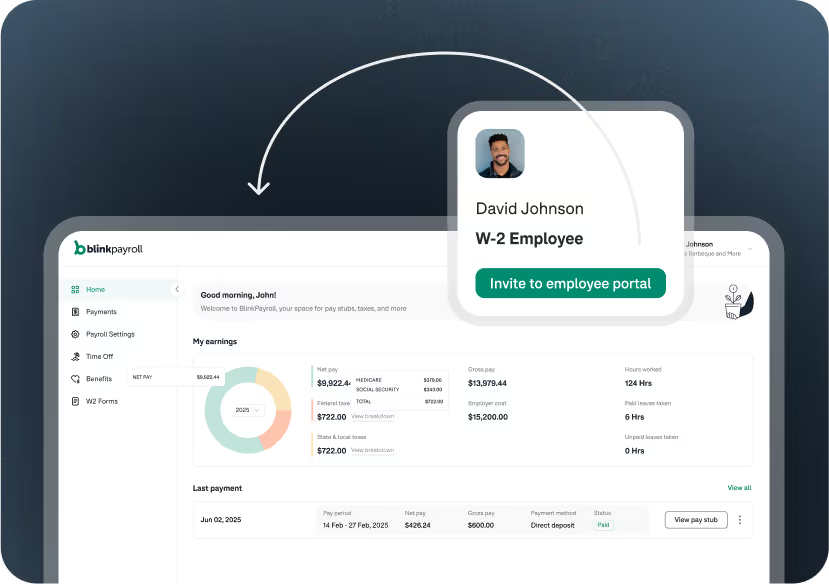

Give employees access to

everything in one place

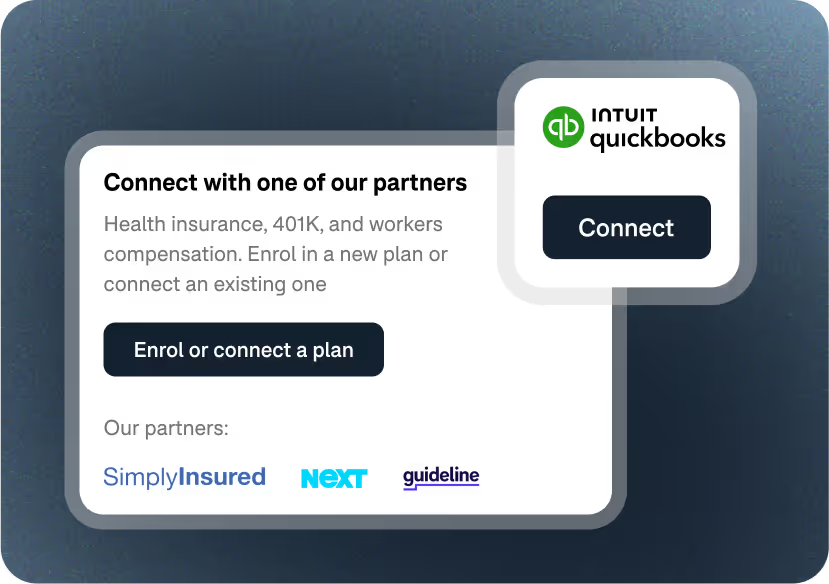

Connect payroll with benefits and accounting tools

Pay contractors in minutes

Trusted by business owners, CPAs, Accountants

Stop stressing over payroll, start with BlinkPayroll today!

Frequently asked questions

Running payroll

Although the time depends on the number of employees and contractors, running a payroll with BlinkPayroll takes just a few minutes. For example, managing payroll for 10 employees typically takes less than 30 minutes.

You can run unlimited payrolls in any given month at no additional cost. We support weekly, bi-weekly and monthly payroll schedules.

Yes, BlinkPayroll supports various types of earnings to meet your specific needs, including tips, commissions, bonuses, and more.

With BlinkPayroll, direct deposit ensures quick and hassle-free payments straight to your employees' bank accounts, and they can easily access their automatically generated pay stubs. Prefer to pay employees yourself? No problem! You can pay your employees in whatever way you prefer, like cheque or cash.

With BlinkPayroll, you can easily add benefits, garnishments, and custom post-tax deductions for each employee. These will be automatically factored into the payroll calculations for accurate, compliant processing.